When we decided to create a platform for RV owners to make money by renting out their RVs, we knew that providing awesome insurance would be key to the whole process.

That’s why we’ve partnered with some of the most well-respected insurers in the business to craft policies that will protect you, your renters, and your RV each time you offer it for rent on our platform.

P.S. Our RV insurance is consistently rated as one of the top in the U.S.!

Here’s the skinny on Outdoorsy’s insurance.

All owners need to know about Outdoorsy insurance

Outdoorsy’s insurance covers you for the whole rental period.

The insurance we offer is known as episodic coverage. For renters, coverage begins the second you hand the keys to them and coverage ends the second they hand the keys back to you. For owners, we are the only platform that extends coverage to rental deliveries and pick-ups.

As an owner, you’ll benefit from up to $1 Million in liability insurance and up to $300,000 in comprehensive and collision protection each time you rent your rig. This insurance is included at no cost to you. Your renter selects an insurance package at the time of booking and will pay for it as part of their rental fee.

We offer three levels of insurance protection.

Your renter can choose the level of insurance protection they want, or you can require that they purchase a certain level to rent your RV.

The main difference between our three levels of insurance is that the more expensive policies carry lower deductibles for your renter. Our highest level of insurance protection is our Premium package, which includes additional windshield coverage and accident interruption to refund your renter for lost days.

No matter which coverage level is chosen, you’ll always benefit from liability coverage, up to $300,000 in comprehensive and collision coverage, and 24/7 support from Outdoorsy.

Your renters pay insurance deductibles.

Folks that rent your RV(s) are responsible for paying all deductibles in the unlikely event your rig is damaged. The Outdoorsy claims team will come alongside you to help collect these fees from your renter and get your camper back on the road ASAP.

You can add additional protection for yourself by requiring your renters to pay a security deposit with each rental. In the event of damage to your rig, you can then hold this security deposit to help pay deductibles and/or repair the damage quickly.

Accidents can happen, we’ve got you covered.

Once you file an insurance claim in your Outdoorsy Owner Dashboard, our claims team will leap into action to help you get your camper repaired and back on the road as swiftly as possible.

Inspect your RV(s) for safety every 90 days to stay eligible for Outdoorsy insurance.

This handy-dandy checklist will walk you through the safety inspection you need to complete. The bottom line is that if you ever have to make an insurance claim, you’ll want to have records showing that you inspected your RV for safety every 90 days and that you quickly resolved any issues like tires, brakes, gas lines, etc. that could create safety hazards on the road.

What types of RVs does Outdoorsy’s insurance cover?

Travel trailers, fifth-wheels, pop-ups, and certified VW Campers, Westfalias, and Vintage units older than model year 2000 will also generally qualify for coverage.

If you have an older vehicle, know that Outdoorsy is the only major RV rental platform that covers vehicles older than 15 years for both Physical Damage and Liability. Vehicles registered in the state of New York do not qualify.

The easiest way to make sure your RV will be covered is to simply list it on Outdoorsy and apply for vehicle protection as part of the process. If your camper is approved, it qualifies for coverage by our insurance.

Be sure your personal RV coverage allows you to rent out your rig.

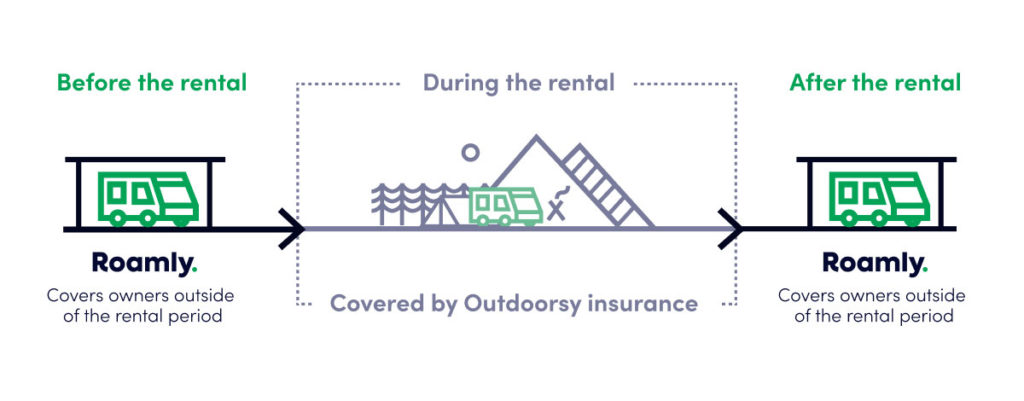

Remember that Outdoorsy’s insurance only covers you during the rental period. For all other times, you’ll need personal RV coverage just as you normally would. However, some RV insurance policies don’t allow you to rent your rig even if you’re covered by us during the rental period.

This means they could deny a claim for damage that occurred during personal use simply because you rent out your rig at other times!

That’s why you’ll want to be sure your personal policy allows this before you start renting your camper on Outdoorsy.

Roamly is our preferred RV insurance partner whose policies cover your personal RV usage and allow you to list your camper on Outdoorsy (and they can save you up to 35% over what you’re paying now for RV insurance). Roamly is RV insurance for RVers by RVers – it’s literally all they do. Plus, Roamly makes it easy to switch your insurance from whoever you have right now.

Remember that Roamly can save you up to 35% over what you’re paying now for RV insurance premiums, making the switch a no-brainer!

Get an instant quote by visiting Roamly

With Outdoorsy, you’re covered!

Insurance can sometimes seem like a daunting web, but we’ve done the legwork for you to keep things simple, safe, and straightforward. We want this whole experience to be a joyful one and one that helps you make extra income. That’s why we’ll always go the extra mile to provide you and your renters with peace of mind on the road.